Air Conditioning & Heating Financing

GreenSky®, the Leader in Home Improvement Financing

Few families have savings accounts bursting at the seams, so an unexpected expense can be catastrophic. If your HVAC unit, plumbing system, or air purifier breaks down at the wrong time, it can quickly carry you into a financial crisis. While the banking industry offers a range of personal loans for that eventuality, you can expect to pay an interest rate of up to 10%. That’s an expensive prospect, so Schneller Knochelmann has developed a range of financing options to back your next home improvement project. Our credit is offered for all our services, including HVAC repairs, indoor air quality improvements, and plumbing repairs.

Our Financing Plans

If your household comfort system needs to be repaired or replaced, we’ll make sure you can make the necessary improvements without breaking the bank. We understand that financial uncertainty can be stressful. Our financing options spread repayments over several months, so they’re affordable and easy to secure. We offer two basic financing options:

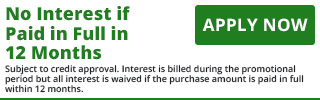

Plan Number 3128 spreads your payment across 12 months. This product is interest-free and charges no hidden fees. If you’re unable to cover repayments straight away, this is the perfect financing option for you. You won’t need to make any payments during the promotional period, so you have plenty of time to generate the extra income required.

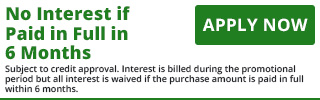

Plan Number 3068 spreads your repayment across six months. This product carries no interest or fees. Like Plan 3128, you don’t need to make any repayments during the promotional period.

Both of our financing plans require no interest payments during the promotional period. Interest will accrue during this phase of the loan, but all interest will be waived if you pay off your account in full within six or 12 months. There are no upfront fees or secured loans. That means you can finance your repairs without paying a cent over the original price. Very few credit lines can offer such attractive terms, but we value our clients, so we think you deserve nothing less.

Please have your chosen plan number ready before you apply.

If you have an existing plan through GreenSky, you can check your balance and make payments here.

Terms

Schneller Knochelmann acts as a service provider on behalf of GreenSky. The financing we offer is carried out through equal opportunity lender banks insured by the Federal Deposit Insurance Corporation of the United States. Our products are guaranteed discrimination-free no matter your gender, religion, disability, or national origin. We operate under fair lending laws, so you can trust us to remain ethically sound and completely transparent.

Servicing Your Loan

GreenSky financing will require a successful credit check. Its average approved borrower credit score is 768. While no cosigners are allowed, GreenSky allows a joint loan option for creditworthy applicants. This way, you can share your repayments. The financing company facilitates home improvement loans of as much as $65,000. It’s often able to fund your loan on the day you apply for it, so we can see to those urgent repairs before they become catastrophic.

More About Repayments

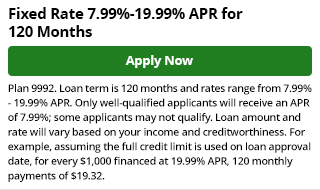

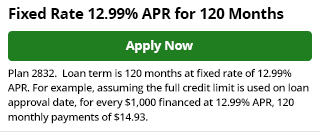

Both of our credit plans are reduced rate loans that incur between 0% and 29.99% interest rates if they’re not repaid within the repayment period. You can apply for your loan via the mobile app or rely on us to handle your red tape for you. Once GreenSky has your hard credit, it will let you know if you’ve been approved and give you the finer details of your loan. It will follow with a shopping pass to cover your repair. We pride ourselves on offering you the very best in the industry. We want your home improvements to be a happy experience, not a stressful one. Call us to find out more at 859-757-1877.

Schneller Knochelmann acts as a service provider on behalf of GreenSky. The financing we offer is carried out through equal opportunity lender banks insured by the Federal Deposit Insurance Corporation of the United States. Our products are guaranteed discrimination-free no matter your gender, religion, disability, or national origin. We operate under fair lending laws, so you can trust us to remain ethically sound and completely transparent.